8 tips for teaching teens how to save money

Topic:

Duration:

Subjects:

Format:

Media type:

Key skills:

Teaching young people to save can be a game-changer for their future financial success. Start by discussing what saving is, why it's important, and how to do it, especially since they're often exposed to mass consumption online.

Remember, saving may be new to them, so if they don't understand its value or find it hard or too much effort, create a supportive environment for open money conversations.

Here’s some tips to help them get started in mastering the art of saving money:

- Saving with purpose It’s important that young people start to build good savings habits early on. Whether it’s for those cool trainers or a bigger future goal, explain the opportunities saving creates.

- Set a savings goal Work with your teen to set realistic savings goals. Create a plan and a timeframe to make it achievable. Many banks offer in-app savings guidance - check them out! Encourage them to set both short-term and long-term goals to stay motivated.

- Save a percentage Instead of a fixed amount, suggest saving a percentage of their money weekly or monthly. Teens' income can fluctuate – for example, they might have more money after their birthday and less money through the summer holidays, so a percentage keeps it flexible. Try the “spend half, save half” method if they don’t have many expenses. This way, saving becomes a habit rather than a chore.

- Fun money budget Ensure teens enjoy their money responsibly. Help them allocate a ‘fun budget’ monthly for things like shopping and eating out while still saving. Teach them to balance fun spending with responsible saving to avoid feeling restricted.

- Track spending Encourage tracking monthly purchases on their phone. Most banking apps have features to help with this. Sit down together weekly to review spending and discuss their savings goals on a regular basis.

- Think twice before spending Teach to avoid impulse buys by considering if they really need an item. Encourage questions like:

- Do I want something more than this item with my money this month?

- Will buying this impact my savings goal?

- Will I still want this in a month’s time?

- Help with job hunting If appropriate, help them find a part-time job that fits around school. Young people can work and earn money from 13 in the UK, although there’s rules about when (and how many hours) people under 16 can work. Show them how to search for jobs, create a CV, and write applications. It can be daunting doing this for the first time. There’s lots of great resources in the NatWest Thrive resource hub to help with this.

- Shop second hand Introduce your teen to second-hand shopping with free apps like Vinted, eBay, and Depop. It’s budget-friendly and better for the environment. Highlight the benefits of still getting their shopping fix with giving up their savings goal. They can also sell unwanted items to earn extra cash.

Remember, the goal is to make saving a positive and rewarding experience, helping them build a strong financial foundation for the future

Here are some further resources that you might find useful

Related resources

Saving with Alisha

Follow Alisha's story and help her save for her future goals.

Topic

- Mastering money

Subject

- Literacy

- PSHE

- Numeracy

- Citizenship

Key Skills

- Problem solving

Age

14-18 years

Duration

15-30 mins

Media Type

PDF

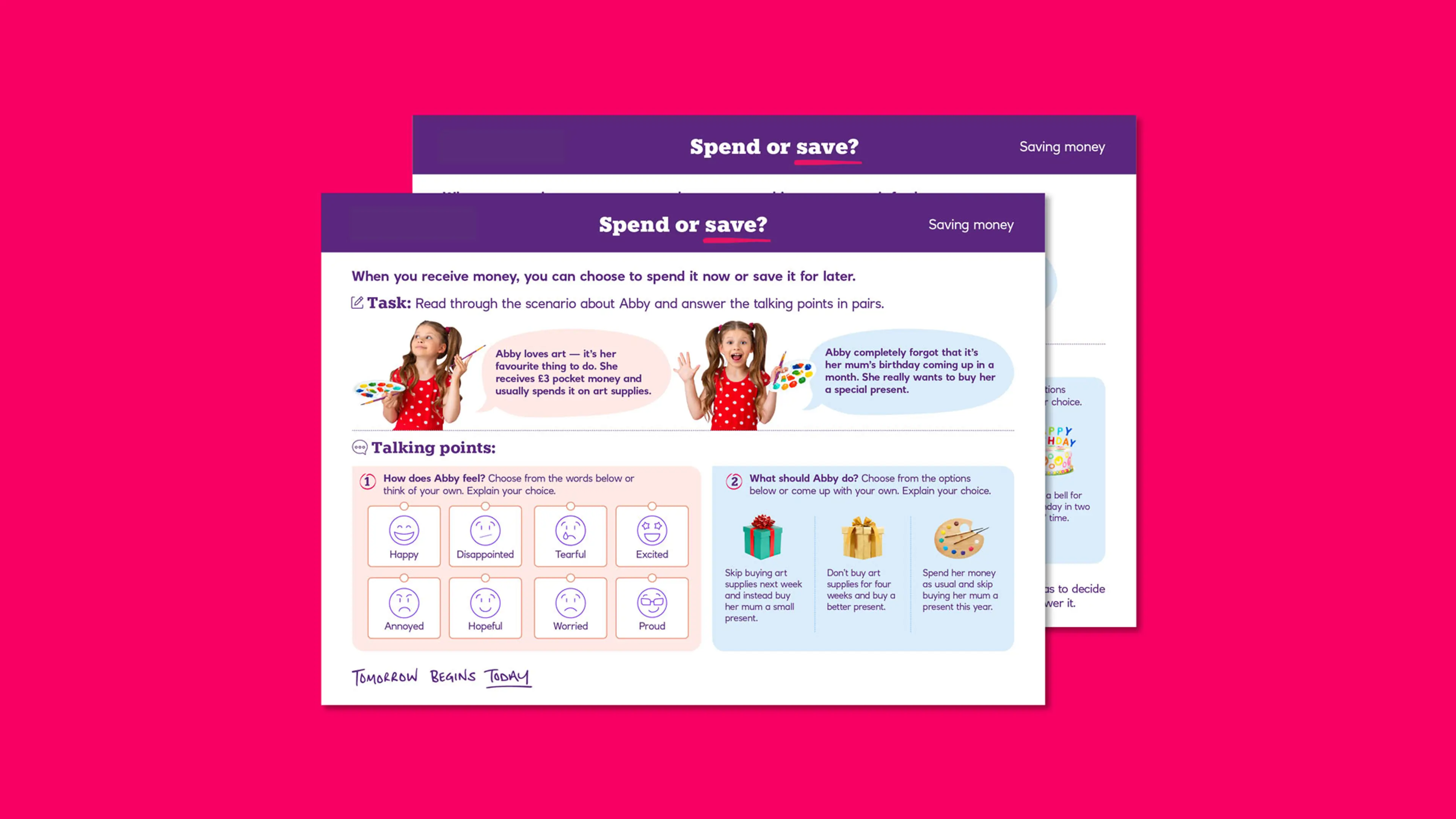

Spend or save?

Look into the choices Abby and Malek make when spending or saving money, and how these decisions can impact their feelings and emotions.

Topic

- Saving money

Subject

- PSHE

Key Skills

- Staying positive

- Problem solving

Age

5-7 years

Duration

15-30 mins

Media Type

PDF

Choices: saving money

Nia's been earning money, but she has some choices to make about how to save for a rainy day. What does it mean, and how can she plan for unexpected costs?

Topic

- Saving money

Subject

- PSHE

- Citizenship

Key Skills

- Problem solving

Age

7-11 years

Duration

15-30 mins

Media Type

PDF