How much pocket money should I give?

Topic:

Duration:

Subjects:

Format:

Media type:

Key skills:

How to decide when to give your child pocket money and how much to give.

Most of us remember the thrill of receiving pocket money as a child, but as a parent, it can bring new dilemmas. When should you start, and how much should you give? Will they spend or save it wisely?

When to Start?

An *Experian survey found that 75% of parents/guardians start giving pocket money between ages five and seven. Once your child can count and understand basic money concepts, they're ready for pocket money, even if it's just a small amount every week. Tie it to chores like tidying up to promote earning.

Toy cash registers and playing shops are great ways to introduce young children to money. As they get older, involve them in real-life shopping to make money more relatable. Parental actions have a greater impact on a child's financial capability than any other education, so talk to your child about money and involve them in everyday purchases.

How Much to Give?

However much you give, they’ll always want more, so don't be swayed by comparisons. Consider:

- How old are they?

- What do you expect them to pay for?

- How much can you afford?

Advice on Spending

Receiving pocket money regularly and deciding how to spend it is vital for financial independence. Some parents/guardians let their children learn from mistakes, while others advise them. Encourage young people to think about purchases and differentiate between wants and needs.

To support your child/children to become more financially capable you could:

- Discuss household income.

- Show how to check a bank balance.

- Set money rules for the family e.g. pocket money, spending, budgets.

- Talk about budgeting and spending using everyday examples like the weekly shop or buying a gift for a friend or relative.

- Talk about how to save a little bit of money each week.

What About Chores?

Should young people do chores to earn pocket money? As family members, they should do certain tasks like cleaning their room without expecting payment. However, paying for non-standard jobs like washing the car can teach the value of work and helps them to think about other ways to earn money.

Saving Habits

Encourage saving money by replicating your behaviour. Talk about setting money aside for emergencies or using labeled money boxes for family events like holidays or Christmas.

Once It's Gone, It's Gone

One key lesson is learning to survive on a budget. Don't top up their pocket money if they spend it all. They'll learn to spread their spending over time.

*Experian Survey 2016

Related resources

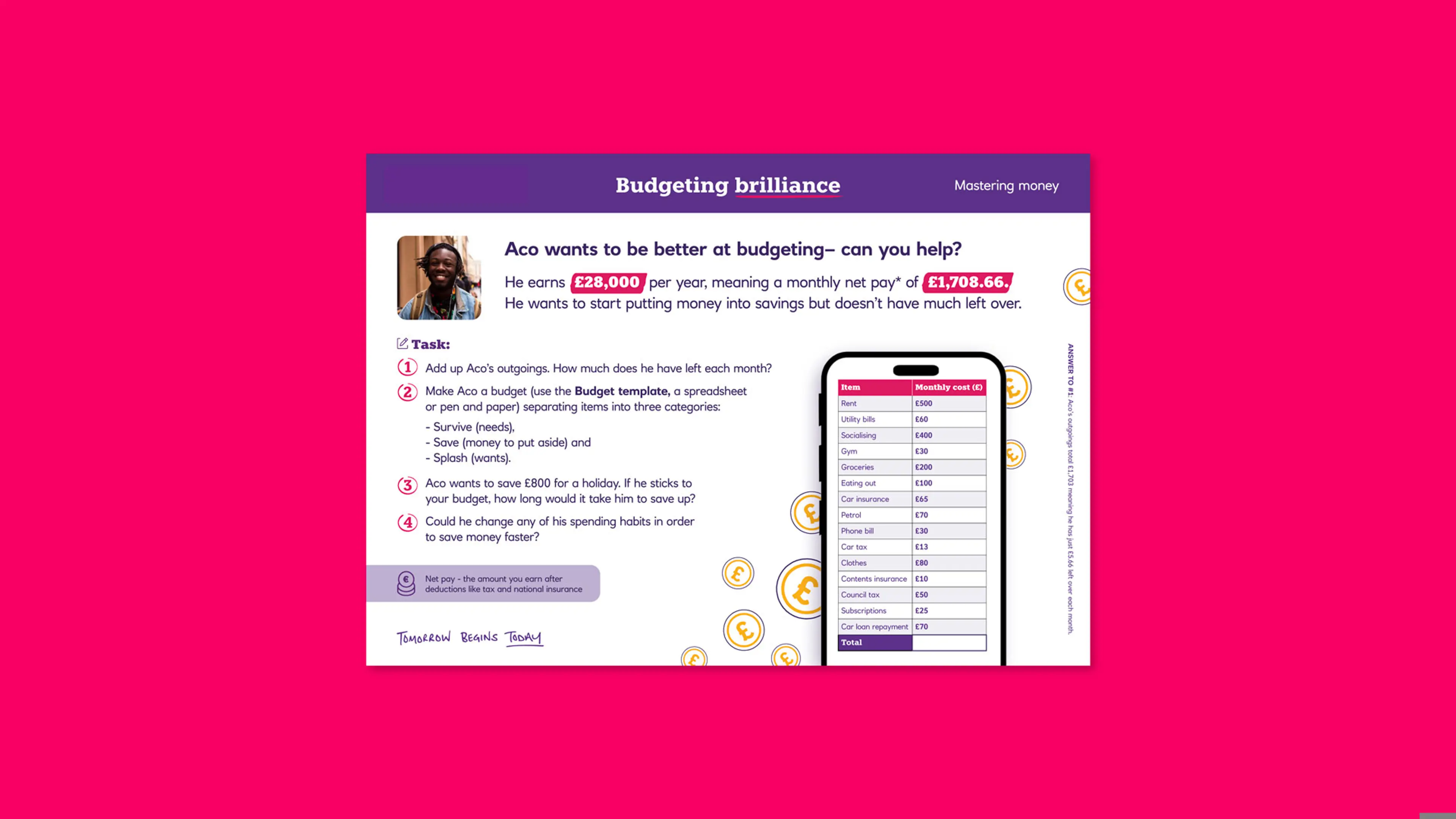

Budgeting brilliance

Help Aco get better at budgeting so he can set aside more of his net pay for savings.

Topic

- Mastering money

Subject

- PSHE

- Numeracy

- Citizenship

Key Skills

- Problem solving

- Teamwork

- Aiming high

Age

14-18 years

Duration

15-30 mins

Media Type

PDF

Understanding savings accounts

Explore the benefits of savings accounts.

Topic

- Money tools

Subject

- PSHE

- Numeracy

Key Skills

- Listening

Age

11-14 years

Duration

5-10 mins

Media Type

PDF

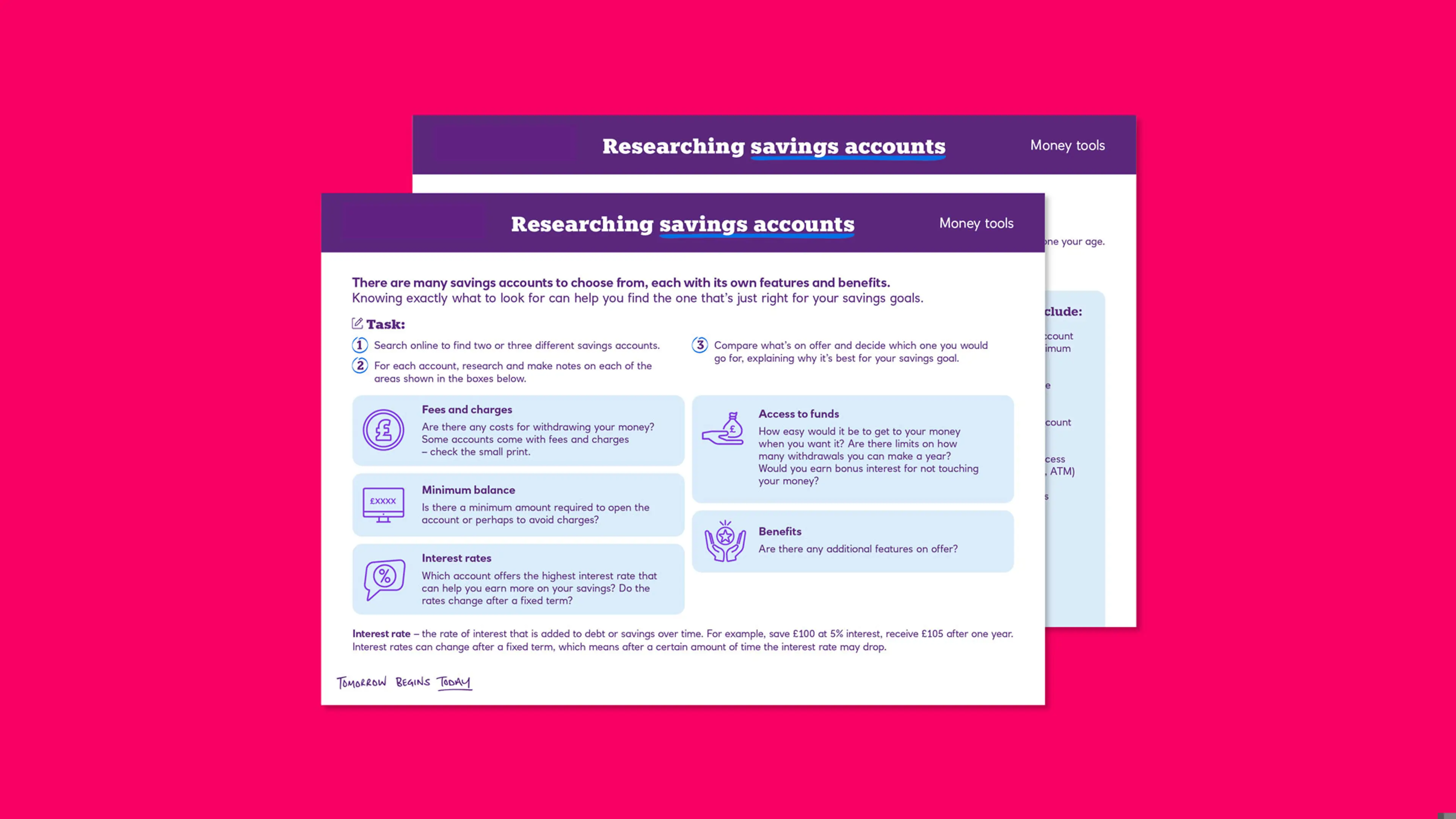

Researching savings accounts

Research savings accounts to help achieve future money goals.

Topic

- Money tools

Subject

- PSHE

- Citizenship

- Computing / Science & Technology

Key Skills

- Creativity

Age

14-18 years

Duration

30-45 mins

Media Type

PDF