How to protect your teen from online scams

Topic:

Duration:

Subjects:

Format:

Media type:

Key skills:

Scams are when you’ve paid a person or company money because you thought they were genuine. They can be very convincing because criminals use social engineering tactics, and anyone can get caught out.

Today, the internet has become a hotspot for fraudsters, increasingly targeting young people. They’re always online, and they can be vulnerable to these convincing scams.

According to Ofcom’s report (Children and parents: media use and attitudes report 2024), 96% of 12–15-year-olds have a mobile phone, and 92% have their own social media profiles. Shockingly, 31% of 12–17-year-olds couldn’t identify a fake social media profile when shown. 75% of 12-15-year-olds said that if they saw something worrying online, they would tell their parent, compared to a teacher (21%), sibling (23%) or a friend (33%).

Common types of online scams

Scammers use various online platforms, including email, SMS, social media, and apps, to commit fraud. Fraud is where money goes out of your account that you didn’t know about. Here are some common types of scams:

Money Mule Schemes: A money mule is someone who, often without realising it, helps criminals hide money by moving it through their own bank account. Young people are increasingly recruited as money mules, unknowingly committing money laundering.

Impersonation: Scammers send emails (often called phishing), texts (smishing), or voice calls (vishing) pretending to be from trusted organisations to steal personal information.

Purchase: Scammers trick you into paying for goods or services that don’t exist.

Friends and family: Fraudsters send you a message pretending to be your friend or family member.

Fake news: Scammers use fake news to bait people into clicking links that may lead to malicious sites. These can be posts appearing to show a celebrity or influencer promoting a product.

Malware & Spyware: Harmful software often spread through gaming and streaming sites, designed to steal personal information.

Social Media Mining: Fraudsters gather personal information from public social media profiles and use fake prize draws to obtain bank details.

Tips to stay safe online

- Shop only on reputable websites and check for misspelled names in the address bar.

- Always check website ratings and reviews before making a purchase, be wary of using an unknown website.

- Set up spending notifications on your banking app and report any suspicious transactions immediately.

- Be cautious of unexpected contacts from unknown companies or individuals.

- When selling online, use secure payment systems and never send goods before receiving full payment.

- Never send money or personal information to unknown senders.

- Choose websites with secure payment pages (look for https:// and a padlock icon).

- Avoid online shopping in public places where personal details can be seen.

- Use strong, unique passwords or a password manager.

- Don’t share personal information unless necessary, you don’t know who you are really talking to online.

Help for Online Fraud Victims

- Take Five: Offers advice to prevent financial fraud.

- Don’t be Fooled: Educates young people about the risks of giving out bank details.

- Action Fraud: The UK's national reporting center for fraud and cybercrime.

Other useful NatWest Thrive resources

Related resources

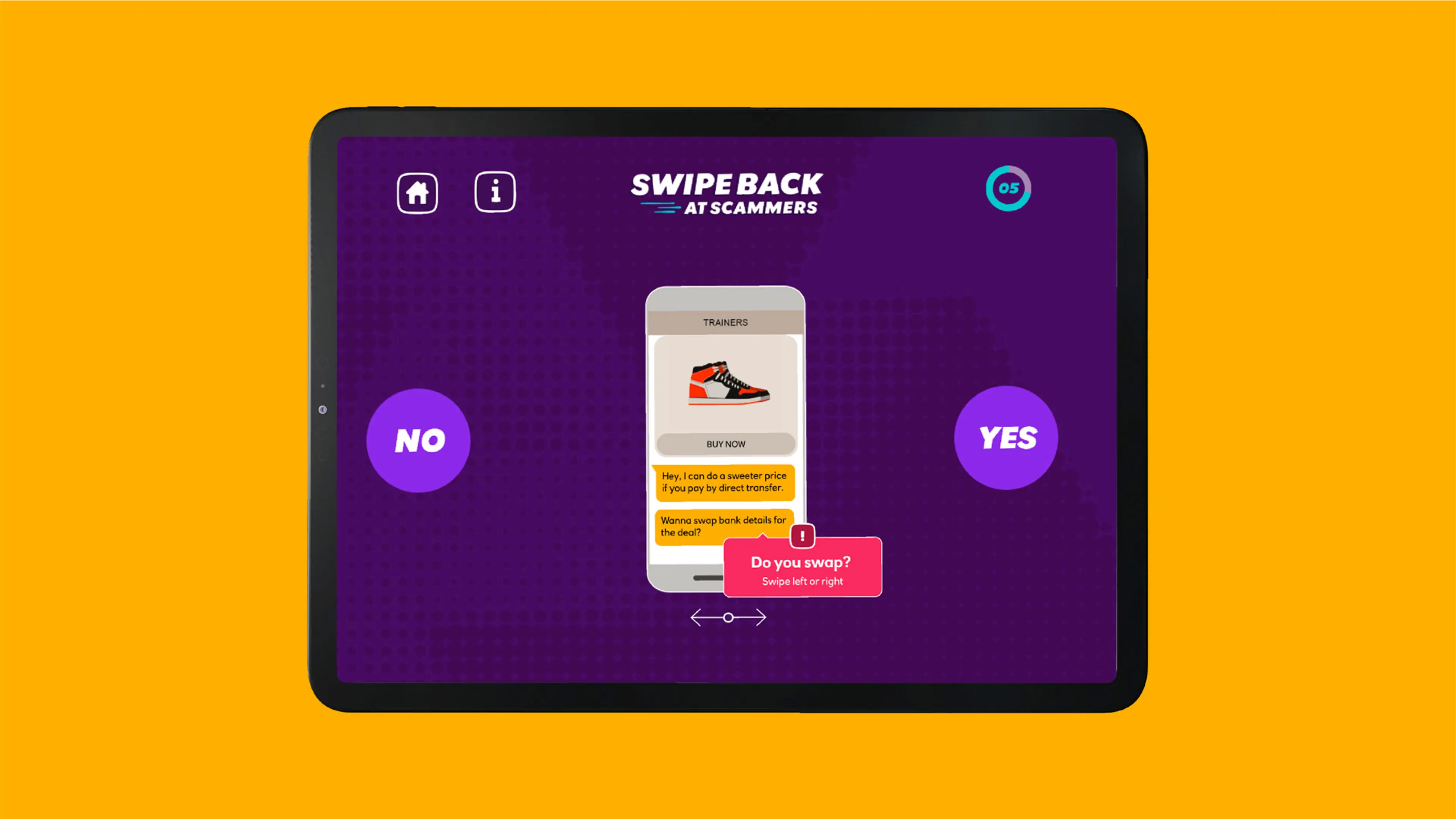

Swipe back at scammers

Correctly identify whether these messages are scams and answer the quiz to consolidate learning about fraud and scams.

Topic

- Money safety

Subject

- PSHE

- Computing / Science & Technology

Key Skills

- Problem solving

Age

11-14 years

Duration

10-15 mins

Media Type

Interactive

Jarvis's story

Follow Jarvis's story of how online gaming got him into trouble with gambling.

Topic

- Money safety

Subject

- PSHE

- Citizenship

Key Skills

- Listening

- Speaking

Age

11-14 years

Duration

30-45 mins

Media Type

PDF

Understanding fraud and scams

Learn how to stay safe from fraud and scams.

Topic

- Money safety

Subject

- PSHE

Key Skills

- Listening

Age

11-14 years

Duration

5-10 mins

Media Type

PDF